Days Sales Outstanding, or DSO for short, is one of the most useful barometers to understanding a business’s financial health. If you’re new to DSO, read on to understand how it works and what it means for your business. And if you’re already a pro at calculating DSO (you are, right?), consider this a helpful refresher.

Everyone has "that vendor". You know, the one that will, without fail, call you if your payment is even one day late. They may be the nicest person in the world, but you know without a doubt that they will call. Every. Single. Time. That's the vendor that will eventually work their way to the top of the payment list. You want to be that vendor.

What we think of as a customer is almost never a lone human. Customers are organizations, and your contact, the one you have a great relationship with, the one you deal with daily--well there's a good chance that's not the person actually paying your bill.

WE'RE PASSIONATE ABOUT DOING A/R RIGHT.

That's why we developed the InvoiceCare A/R Management Approach. This guide is packed with actionable tips and tricks you can implement whether you have one customer or 10,000.

LEARN:

- Can you really "train" your customers to pay on time?

- How a simple phone call can improve A/R by 20%.

- What are optimal payment terms for your business?

- When does it pay to be friendly vs. aggressive

Download Now

It was really exciting to see the checks start rolling in. By the end of the first month, we had effectively moved cash flow ahead by an entire month—a “13th month” of cash flow for the year.

it’s important to fully understand the connection between A/R and your bookkeeping in order to make the smartest financial decisions for your business.

Have you ever sat down at a restaurant and had the waiter deliver exactly what you wanted without you even asking for it? The odds of this magical event happening are approximately the same odds as you getting paid without sending out an invoice. So what are you waiting for? The single biggest lever you have in getting paid quickly is invoicing quickly.

Remember that time when you spotted a great little out-of-the-way restaurant and were really excited until you saw the "cash only" sign in the window and realized your wallet was a little low? Anything that causes friction or causes a customer to push off payment processing to another day is to be avoided diligently. What can you do to avoid this behavior?

Guest Author Chris McKee, Managing Partner of Venturity Financial Partners, talks about accounts receivable, customer invoice followup and how the InvoiceCare virtual A/R team fits in perfectly with Venturity's solutions.

Have you ever looked at your aging report with high hopes that your over-60-days and over-90-days columns would just zero out this once? In this article, we’ll talk about the most common reasons these balances persist.

Before you let the pressures of running a small business get to you, take a deep breath and sit back. In the words of Douglas Adams: DON’T PANIC. If you want to be a stress-free business owner, follow these tips.

The payment terms you’re using are probably “Due on receipt” or “Due in 30 days.” If those aren’t your terms, congratulations! You’re in the minority. However, most people adopted these terms long ago and never looked back. They are by far the most popular. Yet when it comes right down to it, neither one is very effective.

Best case, all your customers pay early or on time. But since we're addressing accounts receivable best practices, we need to address topics like late payment penalties. The late payment penalty is an important lever in your cash flow cycle, so let's talk about how to set them up, how to communicate them, and how best to enforce them.

Tweaking your invoice to perfection is well worth your time. Once you’ve found a winning formula, you can use it over and over again. Just keep in mind that positive results from even small improvements will be multiplied by the hundreds, if not thousands, of invoices you’ll send in the future.

The fact is, humans and animals are a lot alike. We’re creatures of habit. We do things the same way time and time again—until we learn otherwise. We’ve all been trained in various ways, and for you to get the most out of your invoicing and shorten your cash conversion cycle, you’re going to have to train your customers.

This one weird trick can increase the percentage of invoices that are paid on time by more than 5%. And it's really simple: Say please and thank you.

I come bearing news that’s good, weird, and perhaps even a little bit shocking: Your customers want to pay you. Understanding this simple truth can help you reorient your entire accounts receivable strategy so it’s not only friendlier, but also more effective.

Not all invoices are created equal. Not even close. What seems like (and really should be) a straightforward, hardworking document is often a breeding ground for unnecessary confusion, ambiguous directions, or—even worse—self-expression.

We all want to get paid faster, don’t we? And while there are many ways to increase the speed with which your invoices get paid, one of the best ways is re-examining your invoice design.

InvoiceCare was a company built to address a frustration. That small business collections is tough is not shocking. What is shocking is the lengths businesses sometimes have to go to just to get paid, and how few services there are that actually solve this problem.

Despite everything you may have heard or believed about following up on invoices, the fact is that it pays to be nice. Seriously. Forget “getting tough” or “laying down the law.” When it comes to getting a customer to pay you, those manners your mother taught you weren’t too far off the mark.

In 1736 Benjamin Franklin organized Philadelphia’s first fire department, and from that effort arose one of his more famous quotes: “An ounce of prevention is worth a pound of cure.” Here at InvoiceCare we see the results of that adage every day.

Days Sales Outstanding, or DSO for short, is one of the most useful barometers to understanding a business’s financial health. If you’re new to DSO, read on to understand how it works and what it means for your business. And if you’re already a pro at calculating DSO (you are, right?), consider this a helpful refresher.

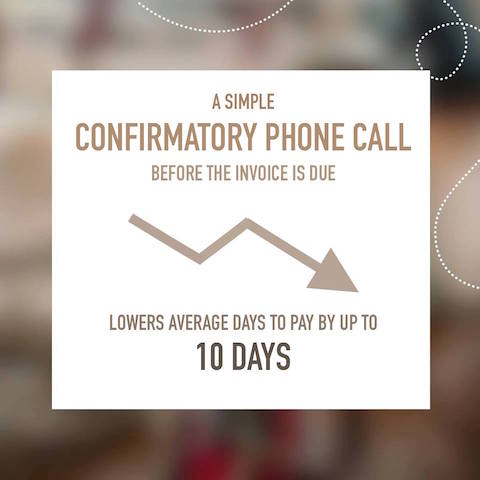

We talk a lot about being proactive when it comes to invoicing, but now let's talk about a specific practice that can make an enormous difference in getting paid faster, lowering Average Days to Pay (ADP) by 10 days for a typical business.

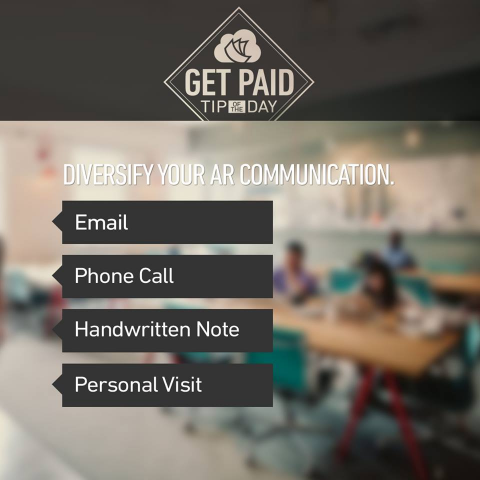

Are repeated email reminders not getting your “please pay me” message through? Do your weekly voicemail reminders seem to be going into a black hole? One of the most important parts of training your customer to pay is diversifying your communications channels.

Everyone has "that vendor". You know, the one that will, without fail, call you if your payment is even one day late. They may be the nicest person in the world, but you know without a doubt that they will call. Every. Single. Time. That's the vendor that will eventually work their way to the top of the payment list. You want to be that vendor.

You probably already know that “getting it in writing” is a good idea when you’re running a business—but you might not be aware of how closely it’s related to getting paid in a timely manner. Let’s look at the basics of creating a contract that will get you paid in full, and paid on time.

It happens. Despite despite delivering fantastic goods and services in a timely manner, sometimes there are customers that simply can't pay your bill. What do you do now? Let's talk about the strategies and options that are most likely to get you paid.

There's an art and a science to telling your customers exactly when to pay you. The more clear and specific you are about your due dates, the the more likely they are to be observed.

Dealing with a client who’s going through financial problems requires that you be proactive. So let’s talk about a few steps you can take to make sure that your client’s financial difficulties don’t become your financial difficulties.

What we think of as a customer is almost never a lone human. Customers are organizations, and your contact, the one you have a great relationship with, the one you deal with daily--well there's a good chance that's not the person actually paying your bill.

Today I’m going to teach you how to beg for your money. Well, not really. But it feels like that sometimes, right? So let's spend a few minutes talking about why it’s so hard to ask for money.

Days Sales Outstanding, or DSO for short, is one of the most useful barometers for understanding a business’s financial health. If you’re new to DSO, read on to understand how it works and what it means for your business. And if you’re already a pro at calculating DSO (you are, right?), consider this a helpful refresher.